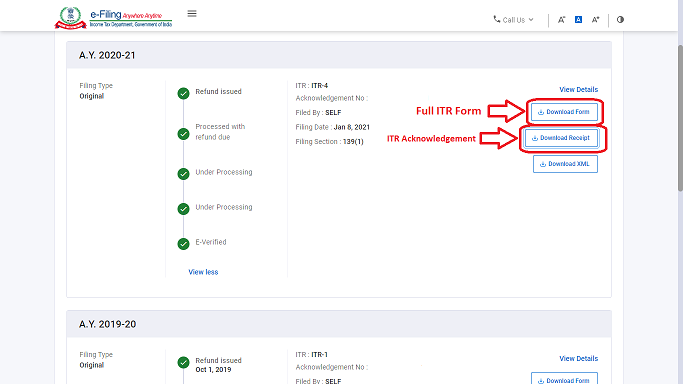

After this, you have to choose appropriate verification option in ‘Taxes Paid and Verification’ tab.Then read instructions carefully and fill applicable and mandatory fields of the online form.Select ‘Prepare and Submit Online’ in ‘Submission Mode’.Hit the ‘e-File’ menu and select ‘Income Tax Return’ link.Login using user ID (PAN), password and captcha code.Visit the official Income Tax Department website.Submitted ITR can be e-verified later by using My Account-e-Verify return option or the signed ITR-V can be sent to CPC, Bengaluru.Verify ITR using any of these options– digital signature certificate (DSC), Aadhaar OTP, EVC using prevalidated bank account details and EVC using prevalidated demat account details.Select ‘Submission Mode’ as ‘Upload XML’.Select ‘Original/Revised Return’ in ‘Filing type’.Select Assessment year and ITR form number.PAN will be autopopulated on the Income Tax Return page.Steps to follow on Income Tax Return page After this, click on ‘e-File’ menu and select ‘Income Tax Return’ link.Login to the e-filing portal by entering user ID (PAN), password, captcha code and hit ‘login’ Validate all tabs of the ITR form and calculate the tax Do fill in the applicable and mandatory fields of the ITR form.Then you need to extract the downloaded ZIP file and open the utility from the extracted folder.Download the appropriate ITR utility under Downloads-IT Return Preparation Software

0 kommentar(er)

0 kommentar(er)